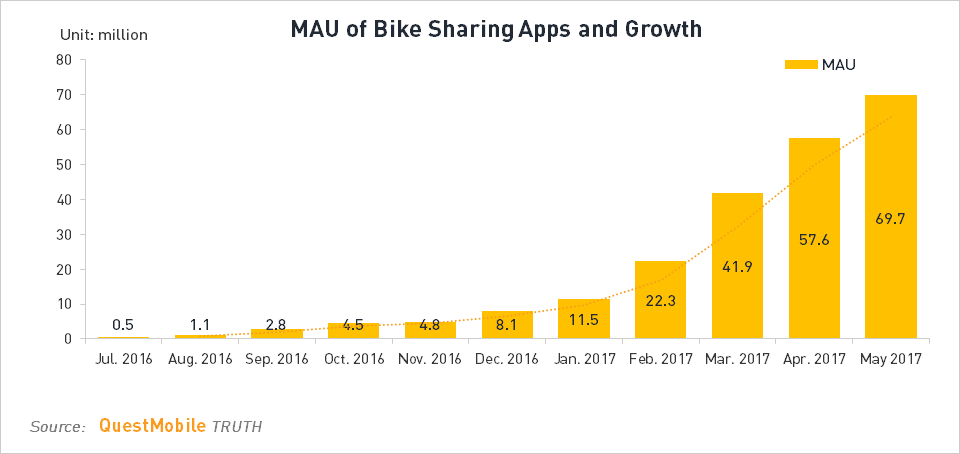

In the past year, especially the past six months, bike sharing industry experienced explosive development, and there were already more than 70 million users by May 2017. In this report, QuestMobile will give you a whole view of this market and the performance of major players.

Geometric Growth of Users

Bike sharing apps sprang up since the second half of last year, with MAU arriving at 540,000 in Jul. 2016. Later, we saw rapid increase of users, and the MAU surpassed 10 million in Jan. 2017 and then approached 70 million in May with monthly compound growth rate of 62.6%.

ofo Surpassed Mobike in Users for the First Time

Mobile competes with ofo since Jun. 2016 and have kept exceeding ofo in the number of users for almost one year. Nevertheless, after explosive growth of users, ofo surpassed Mobike for the first time in May 2017 and formed the first tier of this market together with Mobike.

As for overlapped users, it made up a small proportion of Mobike’s users before Jan. 2017, but there were a relatively large share of overlapped users for ofo, especially from Dec. 2016 to Jan. 2017, indicating that a large number of ofo’s new users were already Mobike’s users. However, benefiting from a series of promotion and marketing activities since Feb. 2017, ofo gained lots of new users who chose it for their first use of this service which led to continuous decline of its overlapped users with Mobike. In May 2017, they basically had the same share of overlapped users, about 30%.

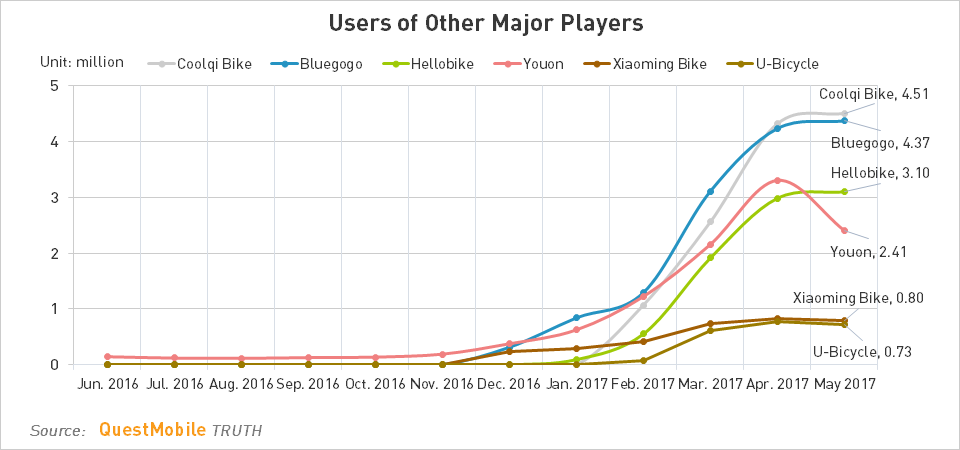

Coolqi Bike Took A Lead Among Second Tier Players

In May 2017, the second tier players in bike sharing market, Coolqi Bike, Bluegogo, Hellobike and Youon, respectively had 4.51 million, 4.37 million, 3.10 million and 2.41 million users.

As the representatives of third tier players, Xiaoming Bike and U-Bicycle, had 0.80 million and 0.73 million users respectively.

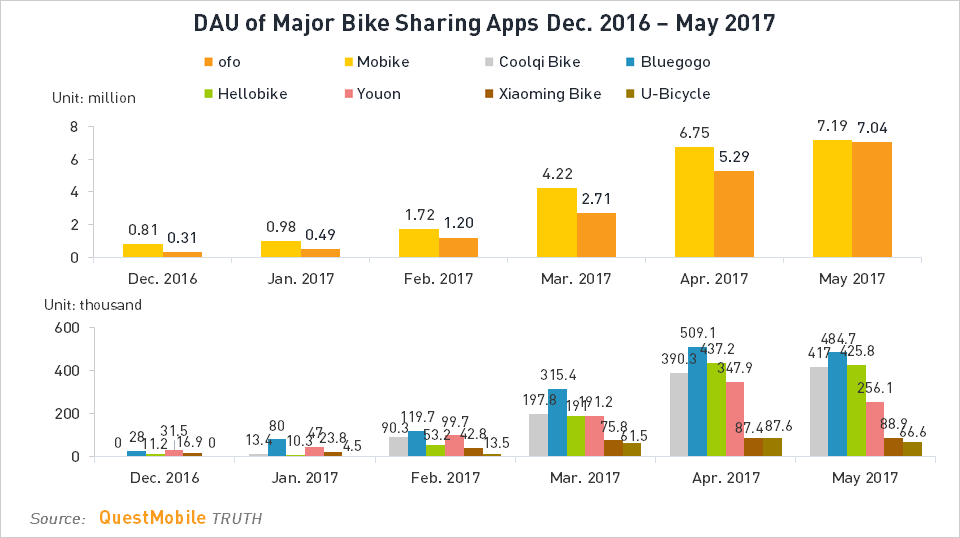

Sustainable Users Growth of Two Giants, Decelerated Growth of Others

With 33% MoM growth, ofo’s average DAU was almost the same as that of Mobike in May 2017. Among other players, Youon experienced 26.5% MoM decline of average DAU in May.

Mobike and ofo’s Users Were Very Active

In May 2017, Mobike took the first place in users activation rate at 20.8%, followed by ofo at 18.7%. The rate for other major apps ranged from 9% to 14%.

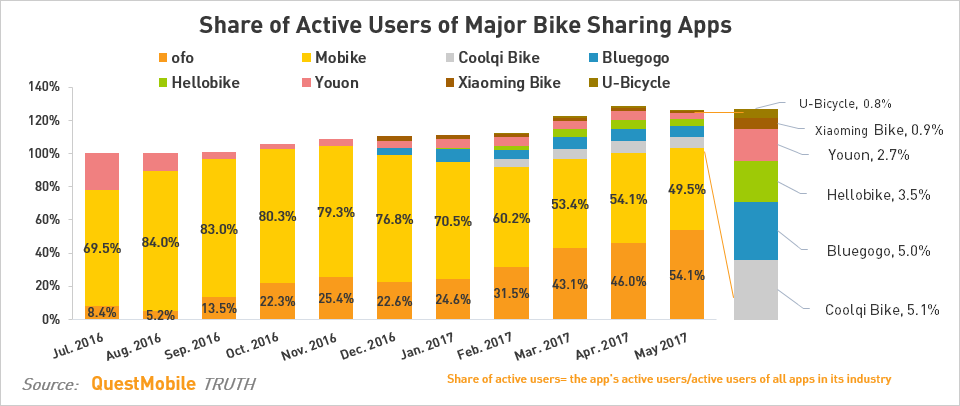

Three Development Stages of Bike Sharing Market

Bike sharing market has experienced three development stages measured by share of active users:

Stage Ⅰ: From Jul. to Nov. in 2016, the market was dominated by Mobike, ofo and Youon. Mobike was the No. 1, as the share of active users was always above 70%. Ofo developed rapidly, with the share of active users increasing from less than 10% to 25%;

Stage Ⅱ: From Dec. 2016 to Apr. 2017, lots of players entered the market. Mobike witnessed continuous decline of share of active users, but it was still the No. 1. After explosive development, ofo expanded its share to 46%, only eight percentage points behind Mobike;

Stage Ⅲ: Since may 2017, ofo surpassed Mobike and the competition becomes fiercer.

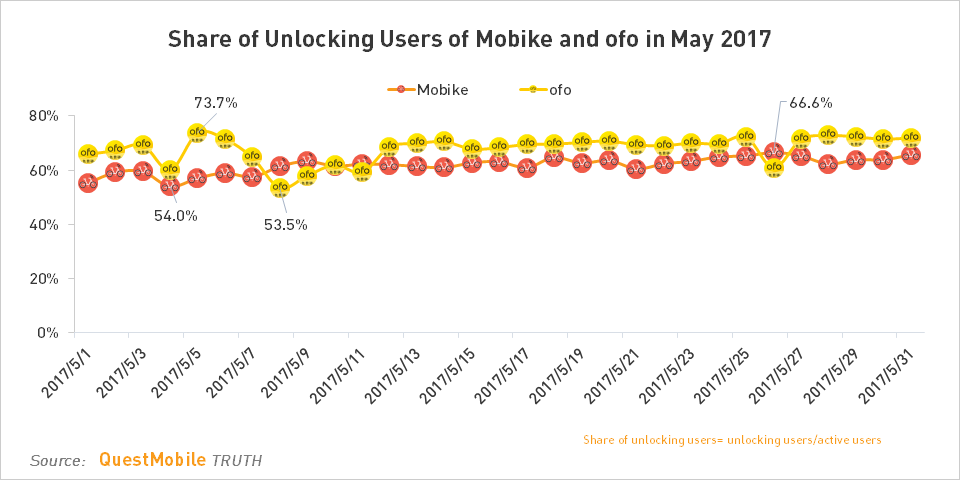

Ofo Had Higher Share of Unlocking Users, While Mobike’s Unlocking Users Were More Stable

The data in May 2017 showed that the share of ofo’s unlocking users was five percentage points higher than that of Mobike, but mobike’s unlocking users were more stable, reflected by less fluctuation.

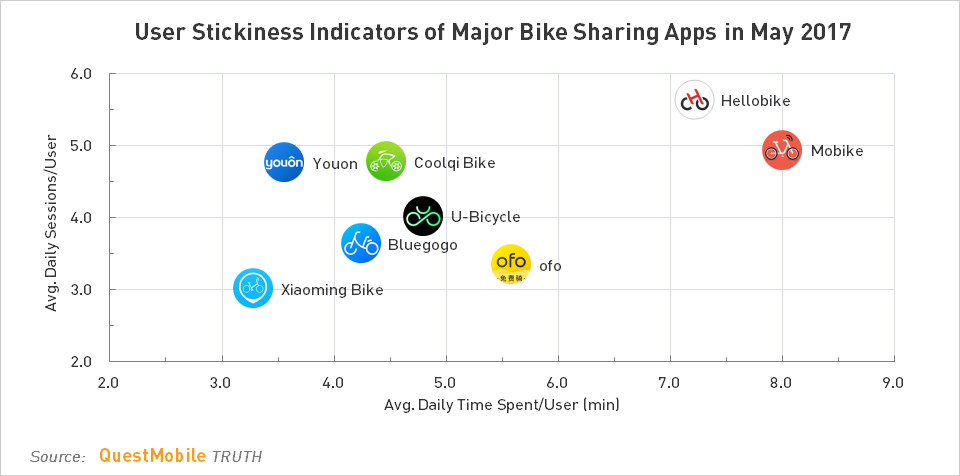

Hellobike and Mobike Performed Well in User Stickiness

In terms of average daily sessions/user, Hellobike, Mobike, Coolqi Bike and Youon had better performance. As for average daily time spent/user, Hellobike and Mobike were the top 2.

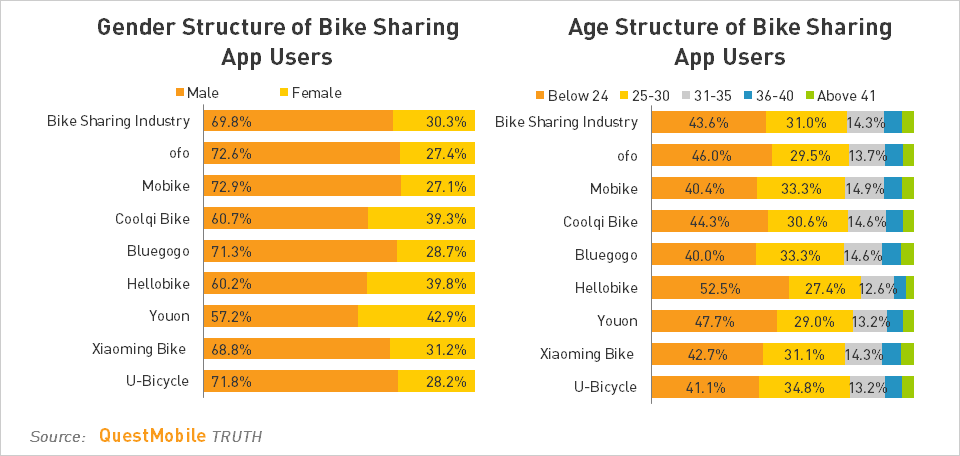

Users Profile

For the whole industry, the ratio between male and female users was 7:3. Except Coolqi Bike, Hellobike and Youon had relatively larger proportion of female users, the users gender structure of other apps was basically the same as the whole industry.

As for users age structure, about 75% of the users were young people below 30 years old. Hellobike’s users were the youngest, with 52.5% below 24 years old.

87% of bike sharing app users were in first and second tier cities. The users city distribution of ofo, Mobike and Xiaoming Bike was basically the same as that of the whole industry, just with a litter higher proportion of users in first tier cities. Coolqi Bike and Hellobike’s users were mainly in second tier cities and Bluegogo’s users were mainly in first tier cities. 70% of Youon’s users were in third and fourth tier cities.

Bike sharing app users generally held strong spending power. Mobike and ofo’s users spending power was the most close to the industrial level, and Xiaoming Bike had the largest proportion of users with spending power above RMB1000.

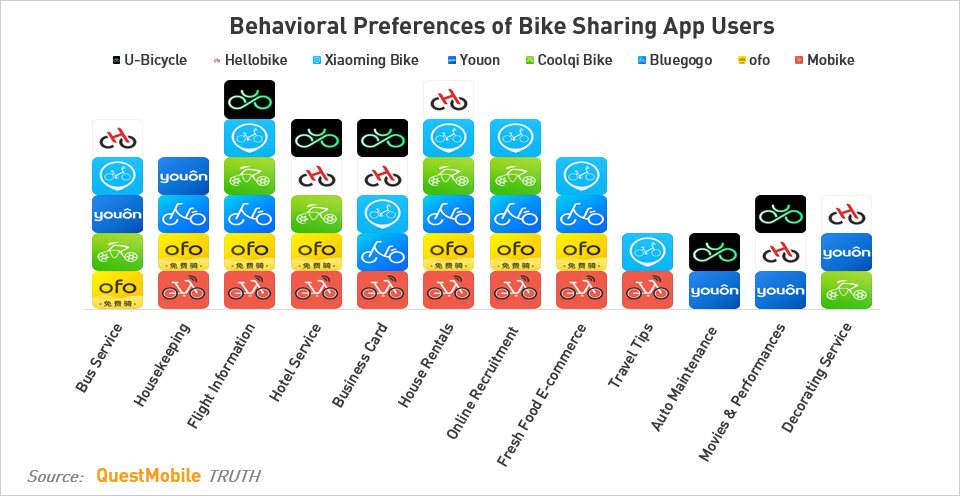

Bike sharing app users showed general the same behavioral preferences. Users of 5 and above apps all preferred “Flight Information”, “Hotel Service”, “Business Card”, “House Rentals” and “Online Recruitment”. Users of different apps had different preferences. For example, Mobike and Xiaoming Bike’s users liked travelling, while U-Bicycle and Youon’s users had the demand for auto maintenance.

Mobike held relatively high downloading – installation conversation rate, showing users’ clear demand when downloading it. There was no distinct difference in installation – activation conversation for monitored apps. As for activation – retention conversation, ofo, Mobike and Bluegogo had eye-catching performance.