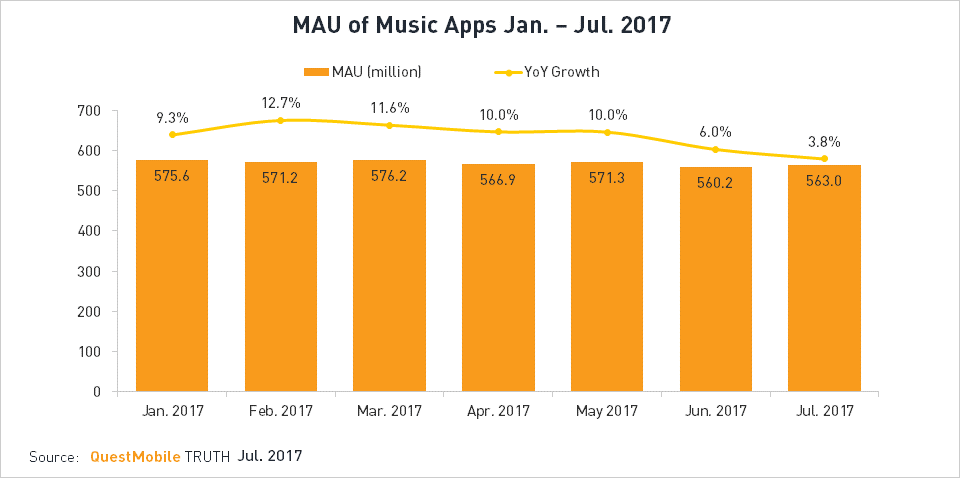

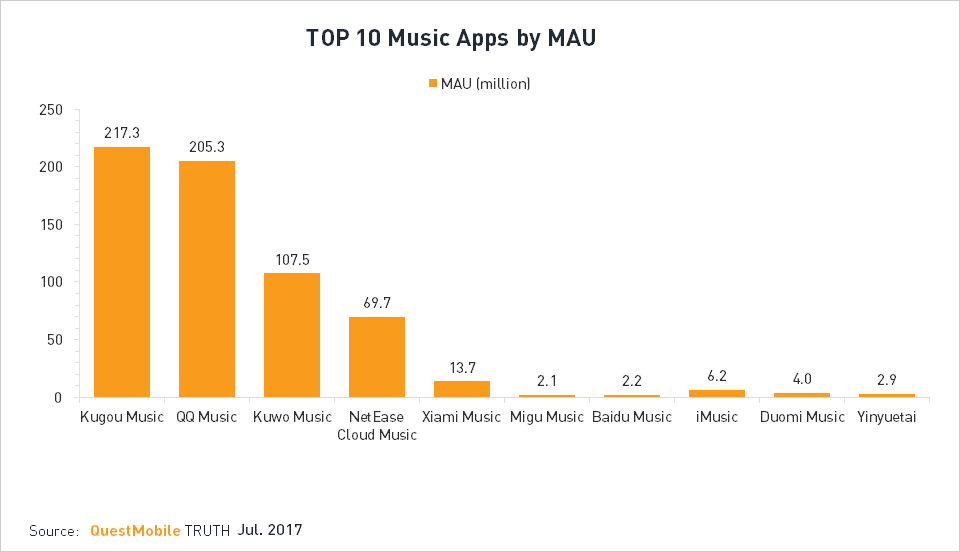

Since Jan. 2017, the MAU of all music apps keeps above 560 million, and the top 3 apps, Kugou Music, QQ Music and Kuwo Music which are all affiliated to Tencent, even have 100+ million MAU.

Decelerated Growth of Music App Users

Since Jan. 2017, the MAU of all music apps keeps above 560 million. However, as the demographic dividend for China’s mobile internet industry is diminishing gradually, the growth of music app users also slows down.

With China’s online music industry being more and more standardized, differentiated copyright is becoming the core competitiveness of various online music platforms, and integration of resources and making better arrangement of music copyright are the main development direction of China’s online music industry in 2017.

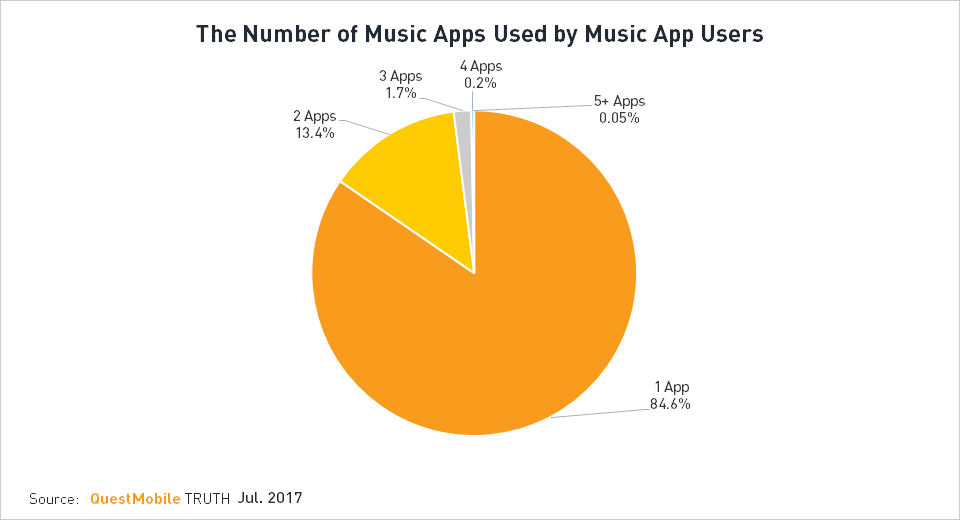

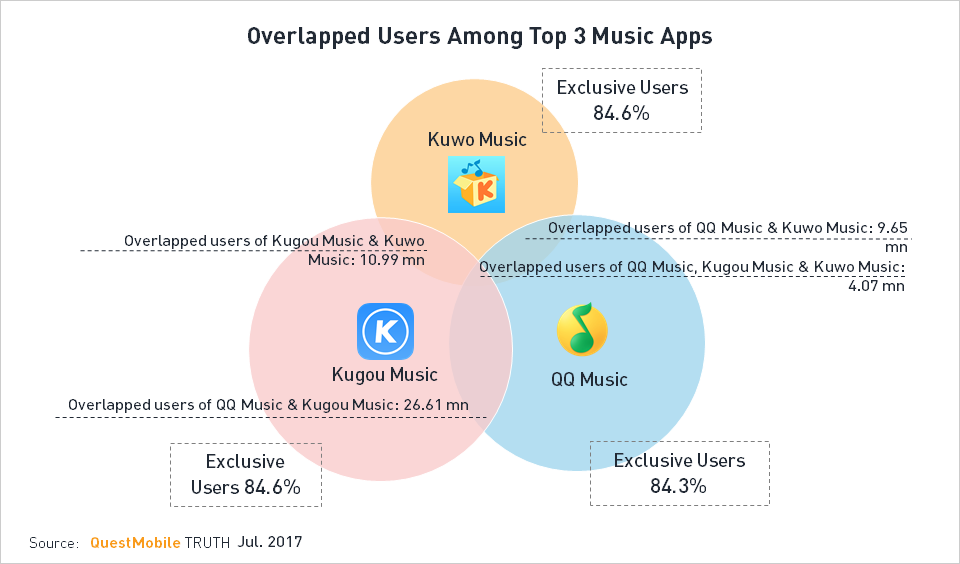

80 Million Users Use More Than One Music Apps

In terms of the number of apps, Tencent holds obvious advantage, as it has QQ music, Kugou Music and Kuwo Music. For most users, one music app can basically satisfy their need, but since no app can cover all copyrighted music, about 15% of or 80 million users would like to use more than one apps. With Tencent integrating its music business, it may monopolize the high-quality resources of this industry and the market pattern will also take shape gradually.

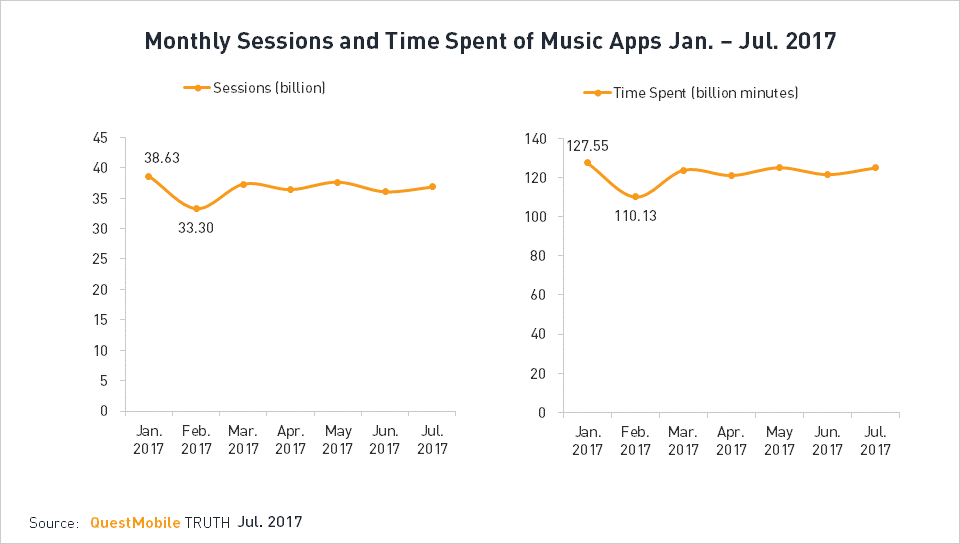

Steady Increase of User Stickiness

Except in Feb. when people were celebrating Spring Festival, the monthly sessions and time spent of music apps are relatively stable in 2017. The data show that a user averagely starts a music app 60 times and spends 220 minutes on it a month, reflecting users’ stable need for online music as well as steady increase of user stickiness.

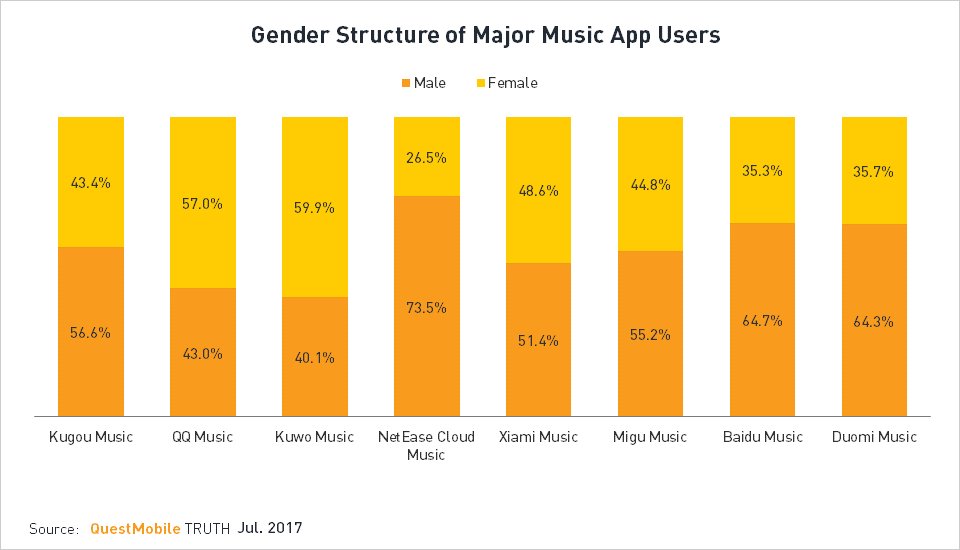

Almost Fifty-fifty Male and Female Users

The ratio between male and female users is almost fifty-fifty, basically consistent with the gender structure of all mobile internet users.

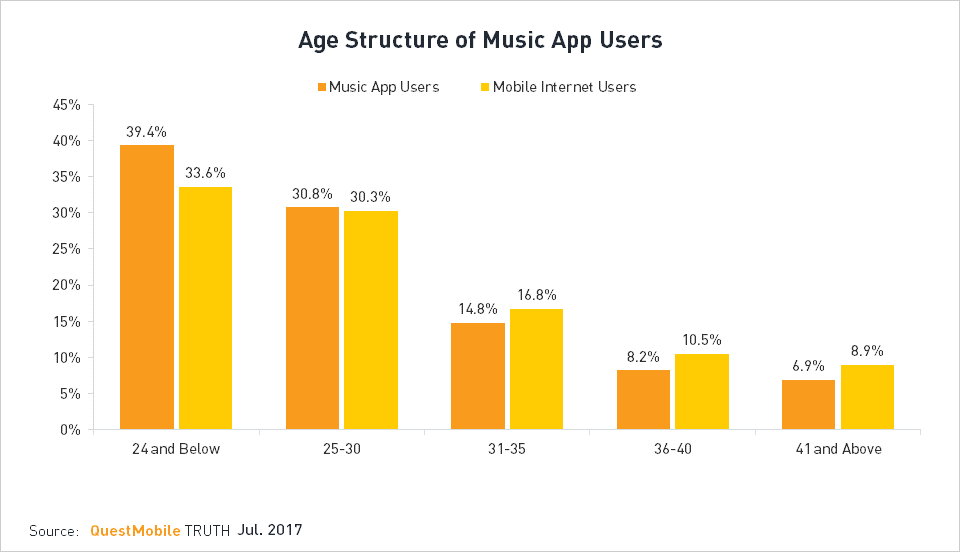

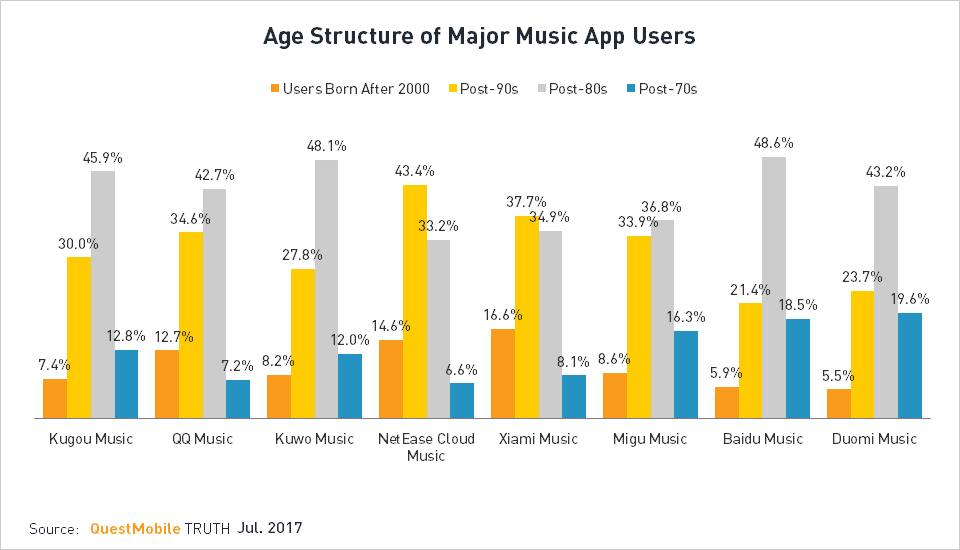

Age Structure of Music App Users

Diversified music can meet the need of users in different age ranges, but online music is more attractive to young people, as users below 30 years old occupy the largest proportion.

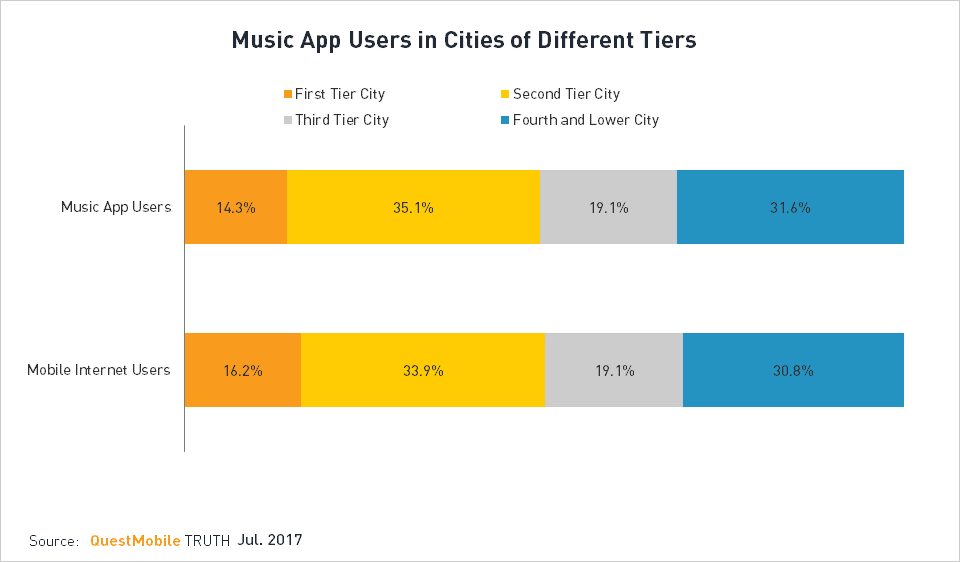

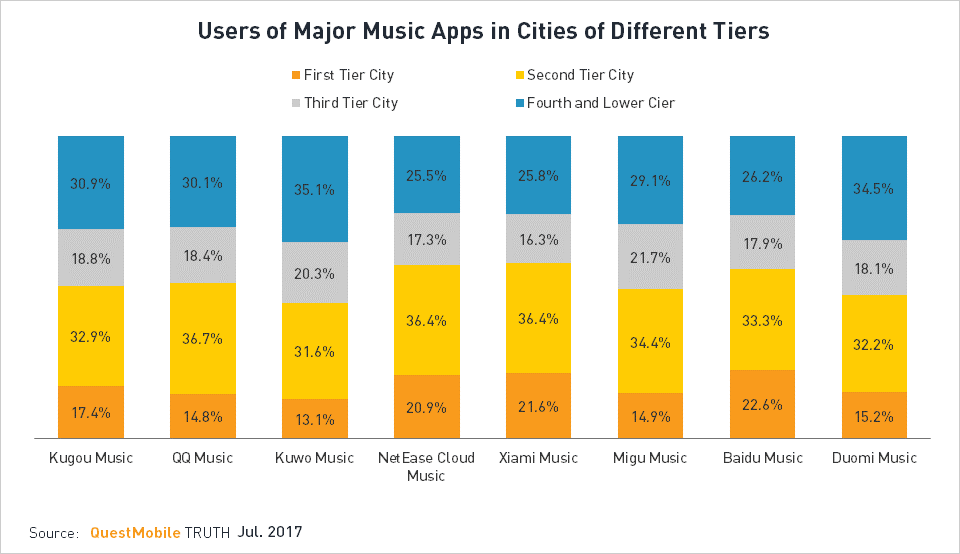

Music App Users in Cities of Different Tiers

Comparing with all mobile internet users, music app users from second tier cities make up a larger proportion.

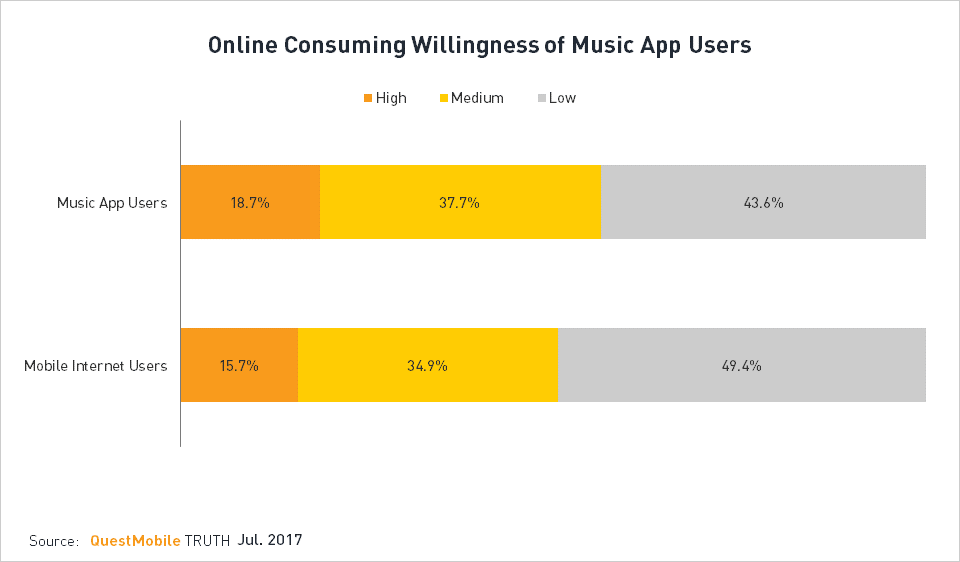

Online Consuming Willingness of Music App Users

Comparing with all mobile internet users, there are more users with medium to high online consuming willingness among music app users, indicating great value potential.

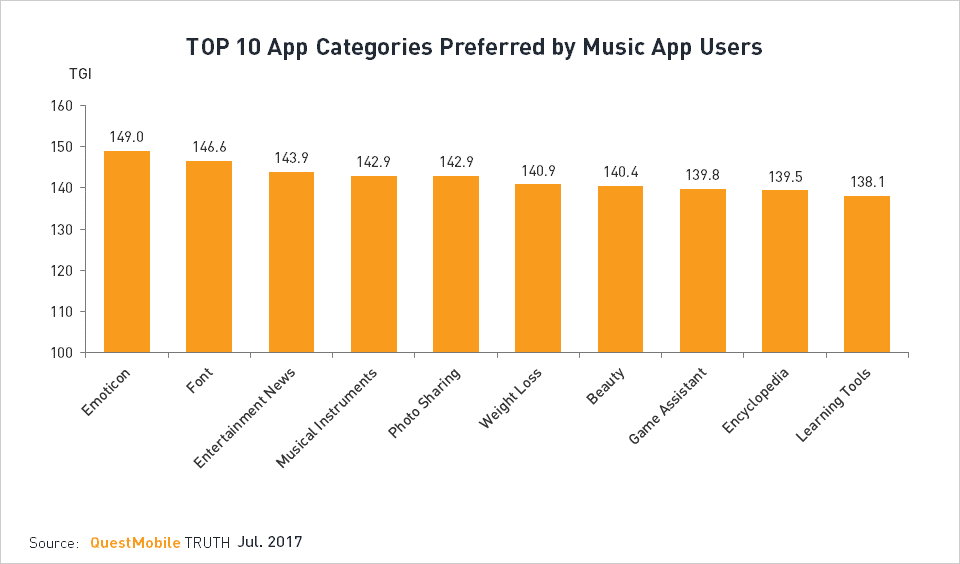

Music App Users Are Fond of Entertainment

Music app users are interested in emoticon, entertainment news as well as games. They are also lover of beauty, because they like sharing photos and care about their appearance.

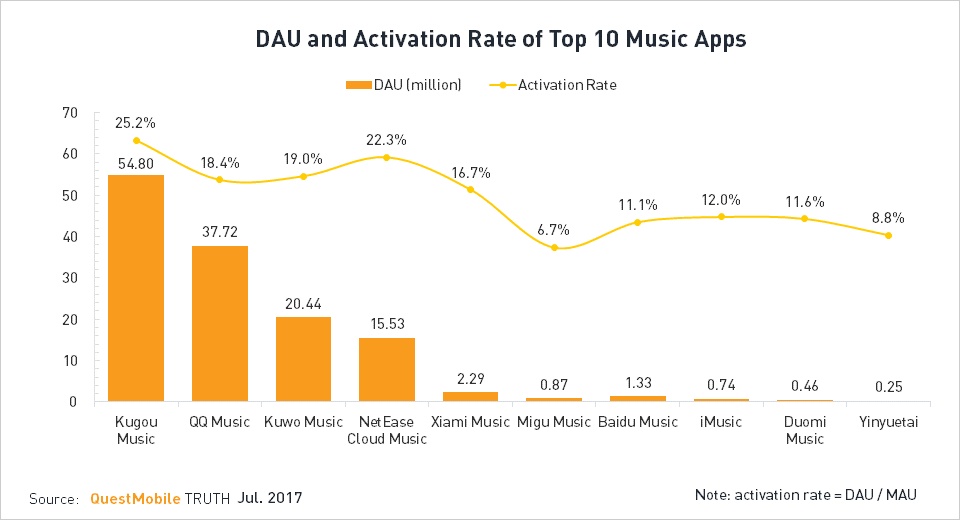

Oligarchic Trend of Online Music Market

After continuous mergers and acquisitions, there is already an obvious oligarchic trend in domestic online music market. Among top 10 music apps, there are three apps with 100+ million MAU, and NetEase Cloud Music also has nearly 70 million MAU, widening the gap between other apps gradually.

Great Difference in Users Activation Rate

For users, music apps are more than a tool to listen to music. Fore example, Kugou Music has developed into an entertainment service platform integrating songs, radio, live streaming, karaoke, etc., while QQ Music puts lots of effort into music community service in addition to online music. Based on their advantage in users, leading apps manage to make users more active and sticky through their efforts in platform content and operation as well as product innovation.

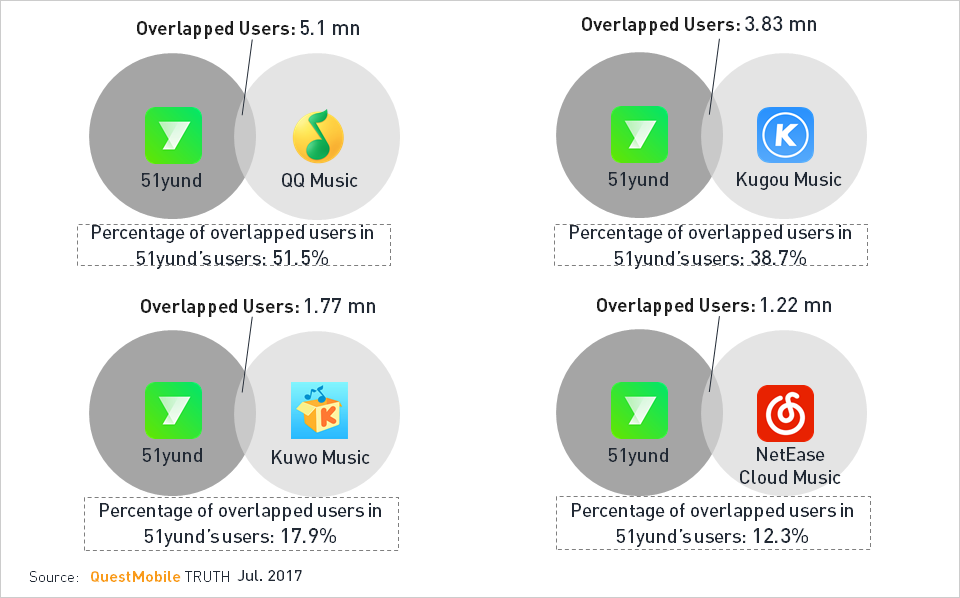

Overlapped Users Analysis

Although QQ music, Kugou Music and Kuwo Music has been merged into Tencent, they are still operating separately, and there are not many overlapped users.

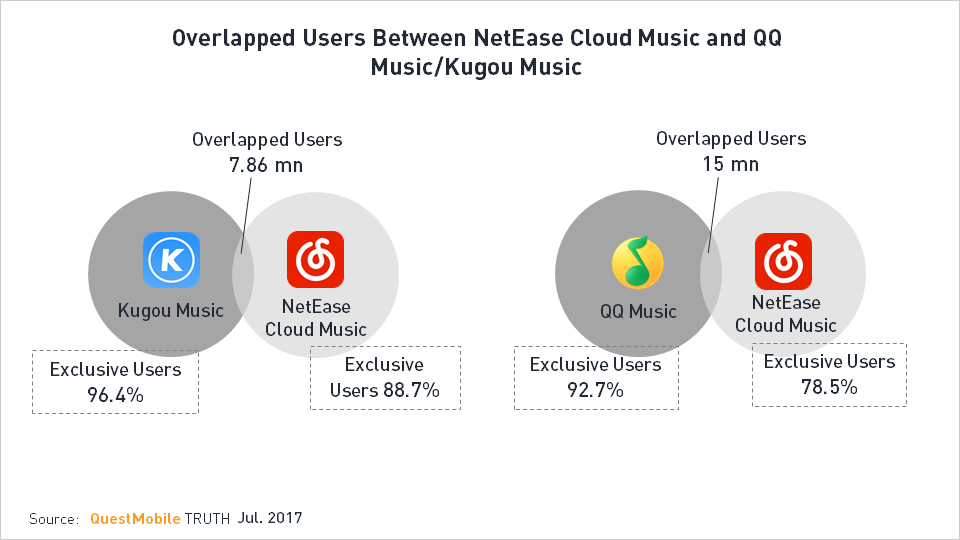

Overlapped Users Analysis

NetEase Cloud Music has nearly 15 million users overlapping with the users of QQ Music, almost two times as many as the overlapped users with Kugou Music.

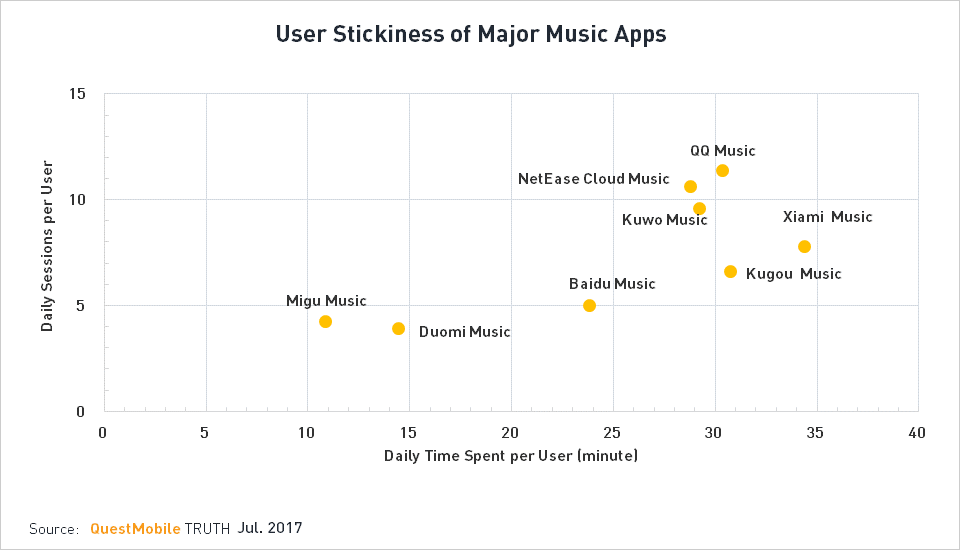

User Stickiness Analysis

In terms of user stickiness measured by daily sessions and time spent per user, the gap among different platforms is narrowing. QQ Music and NetEase Cloud Music perform well in sessions, while Xiami Music and Kugou Music are advantageous in time spent. Kuwo Music is generally balanced in the two indicators.

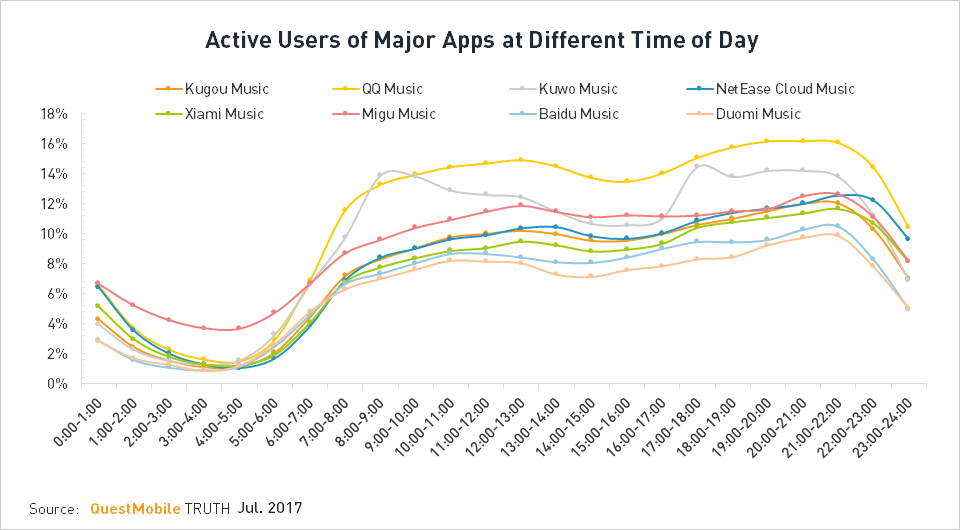

Active Users of Major Apps at Different Time of Day

Similar to most apps, night is the prime time for music apps. Nevertheless, various apps still have their respective characteristics. Kuwo Music’s users are rather active at noon and night, QQ Music’s users are very active, especially from 9 to 10 o’clock at night. Migu Music and NetEase Cloud Music see a small peak of usage at noon.

Users of Major Music Apps in Cities of Different Tiers

For major music apps, their users are mainly in second and fourth tier cities. NetEase Cloud Music and Xiami Music which have mobile internet background are more popular in first tier cities, while Kuwo Music, Migu Music and Duomi Music have larger proportion of users in lower tier cities.

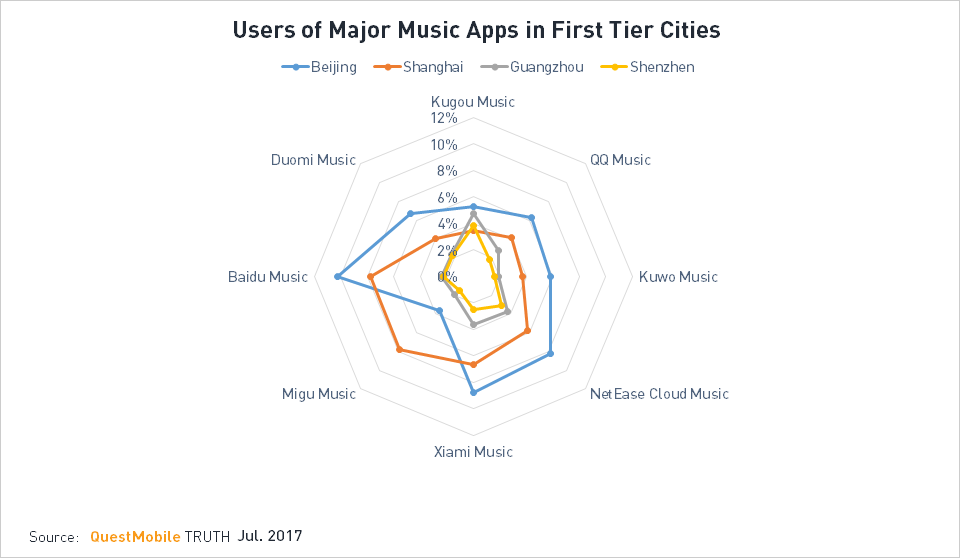

Users of Major Music Apps in First Tier Cities

Baidu Music captures a large number of users in Beijing and Shanghai. Migu Music’s users mainly come from Shanghai, while Kugou Music is more popular in Guangzhou and Shenzhen.

Gender Structure of Major Music App Users

The data show that males prefer NetEase Cloud Music, Baidu Music and Duomi Music, while QQ Music and Kuwo Music are more popular among females.

Age Structure of Major Music App Users

QQ Music, Kugou Music and Kuwo Music’s users are mostly post-80s, while Xiami Music and NetEase Cloud Music’s users are younger, with post-90s and users born after 2000 occupying large proportion.

Overlapped Users of Music Apps and Running Apps

Music apps and running apps have some overlapped users, indicating that people have used to listening to music when running.