As a relatively new market segment of e-commerce, fresh food e-commerce combines online and offline business together. With internet giants including Alibaba and JD tap into this market one after another, it is expected to become a hot market soon.

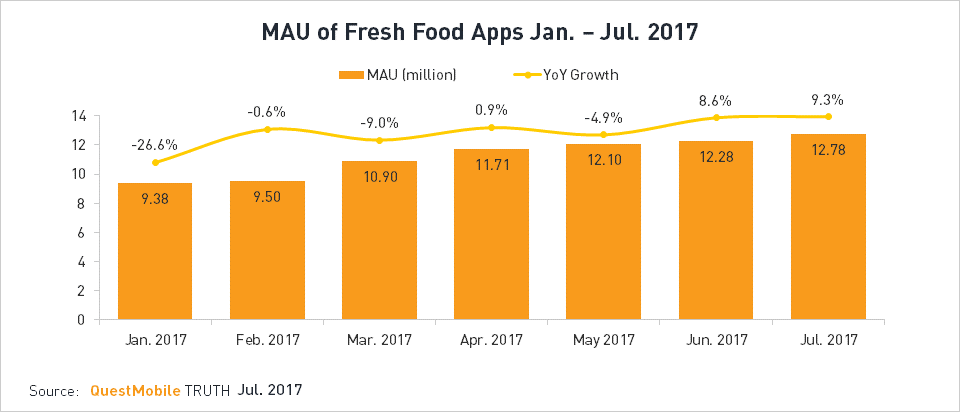

Solid Growth of Fresh Food Shopping App Users

As a market segment of e-commerce, fresh food e-commerce develops well in 2017 and shows solid growth trend.

Three new stores which were opened in Beijing and Shanghai simultaneously reflect that Hema is stepping into rapid development stage. Zhangyu of Meituan which represents a new retail pattern was opened. Yiguo obtained 300 million dollars investment to upgrade ExFresh which is affiliated to it. JD Daojia achieved cooperation with Walmart to integrate offline stores, warehouses and users.

With increasing consumption scenarios and traffic entrance, users are facing more options and can place orders anytime and anywhere.

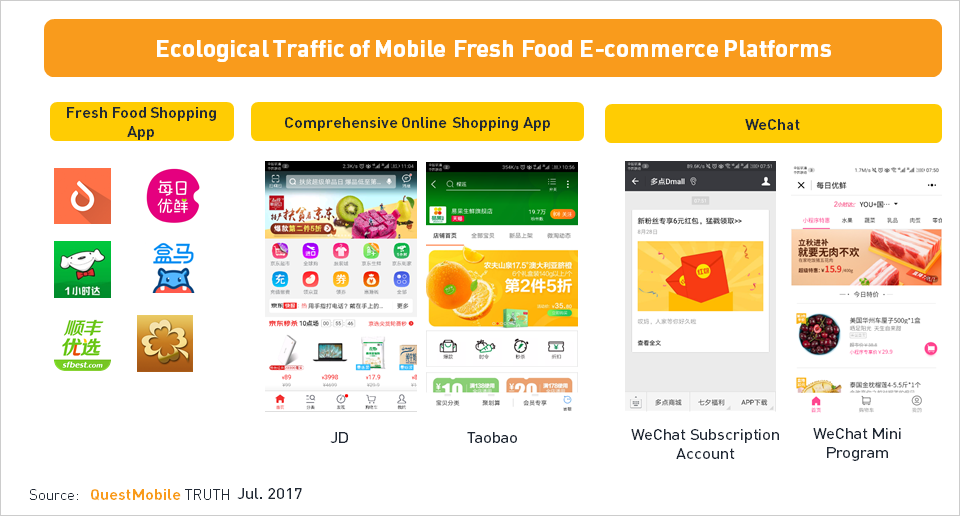

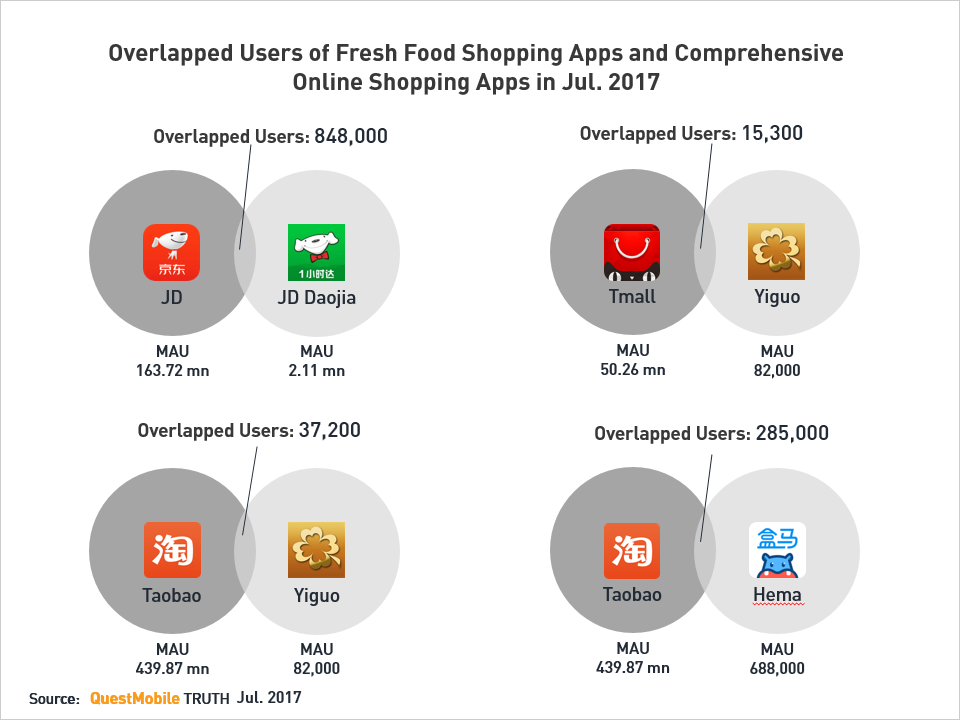

Ecological Traffic of Fresh Food E-commerce Platforms

More and more mobile fresh food e-commerce platforms are aware of the importance of ecological traffic which will help to increase traffic entrance and let platforms cover more consumption scenarios. Besides app, the traffic entrance also includes comprehensive online shopping apps such as JD, Taobao and Tmall, WeChat subscription accounts and WeChat mini programs. Fresh food e-commerce operators aim to attract consumers from different scenarios and make consumers get used to buying fresh food online.

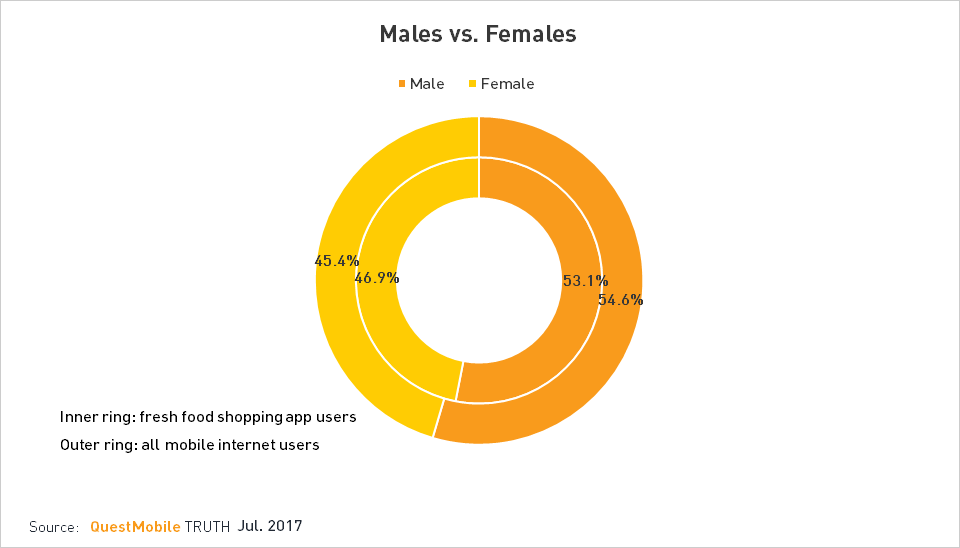

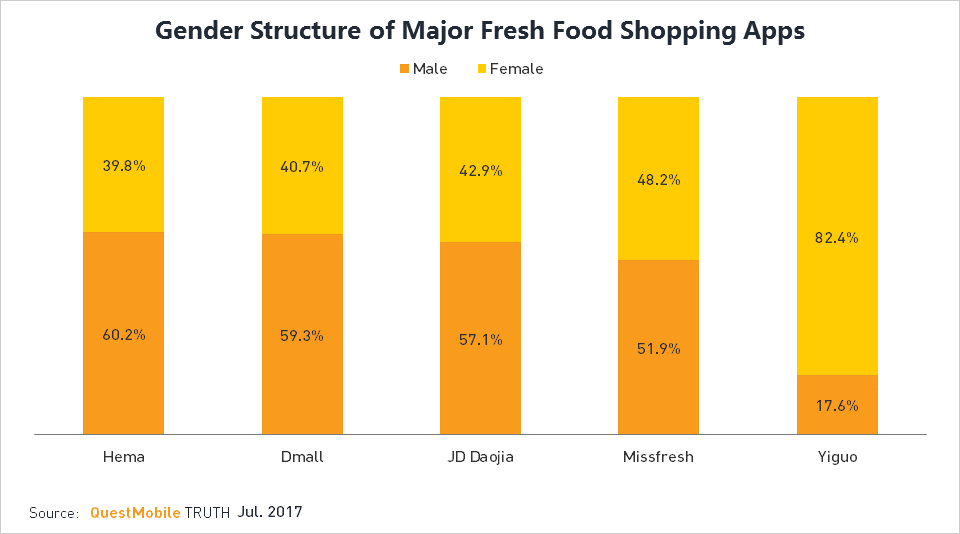

Basically Balanced Male and Female Users

In terms of the gender structure of fresh food shopping app users, females don’t hold a dominant position, indicating that more and more males begin to buy vegetables and fruits online.

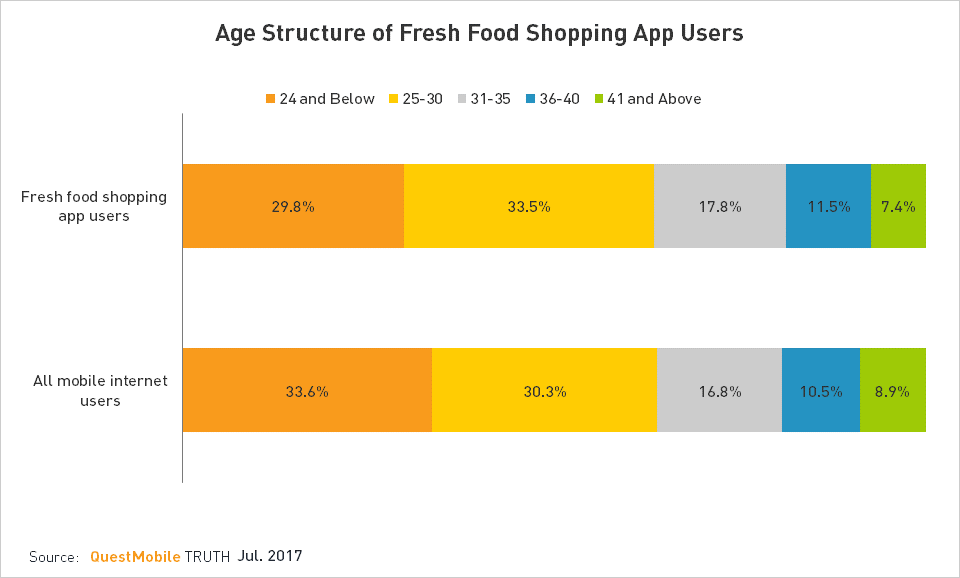

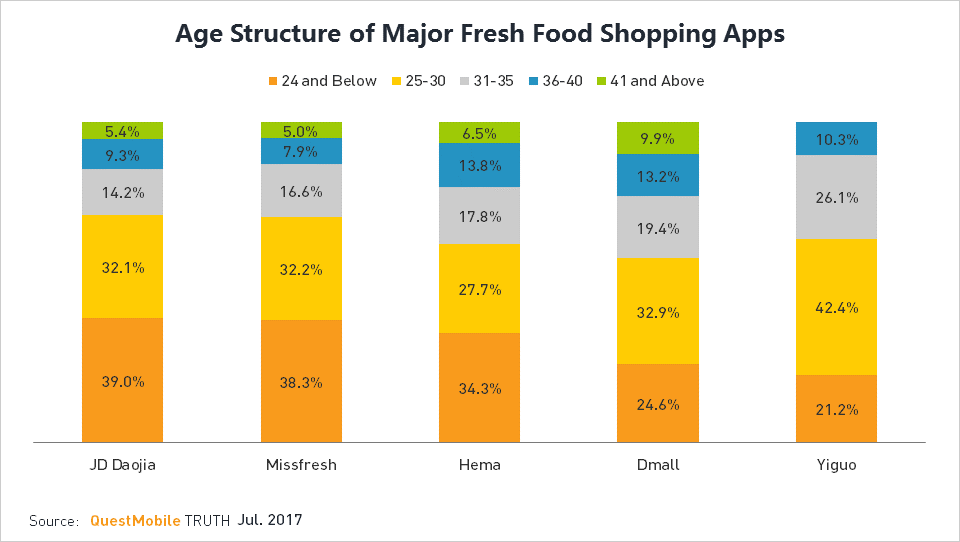

Age Structure of Fresh Food Shopping App Users

The age structure of fresh food shopping app users accords with that of all mobile internet users.

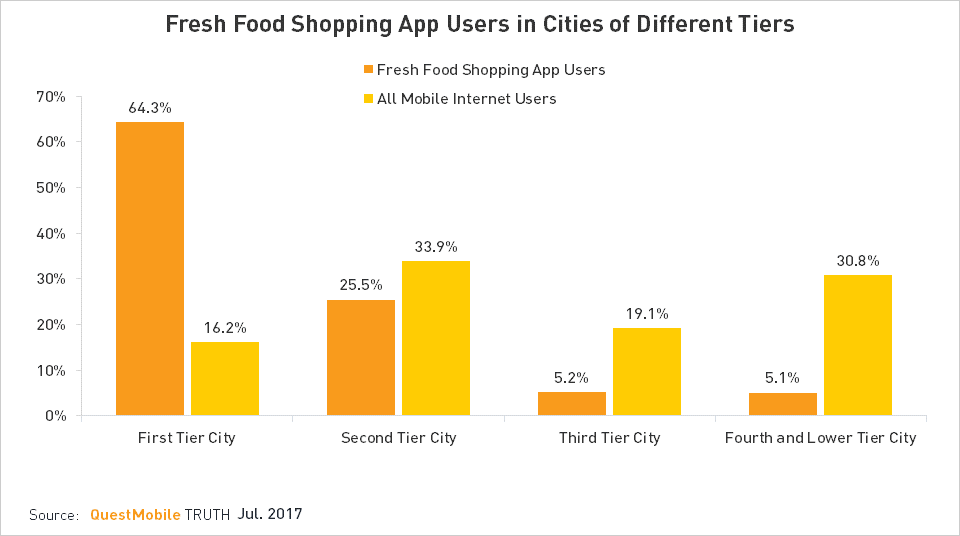

Users in Cities of Different Tiers

First tier cities are definitely the leading market of fresh food shopping apps. In densely populated cities, there are more upper-income people with high-consuming lifestyle who would like to buy fresh food online. Meanwhile, the well-developed logistics system in these cities also drives development of fresh food e-commerce.

Fresh Food Shopping App Users Care About Life Quality

Fresh food shopping app users pay close attention to quality and delivery speed of food, reflecting their pursuit of high-quality life. Meanwhile, they also show preference for such fields as healthcare, business affairs, real estate, cars, etc.

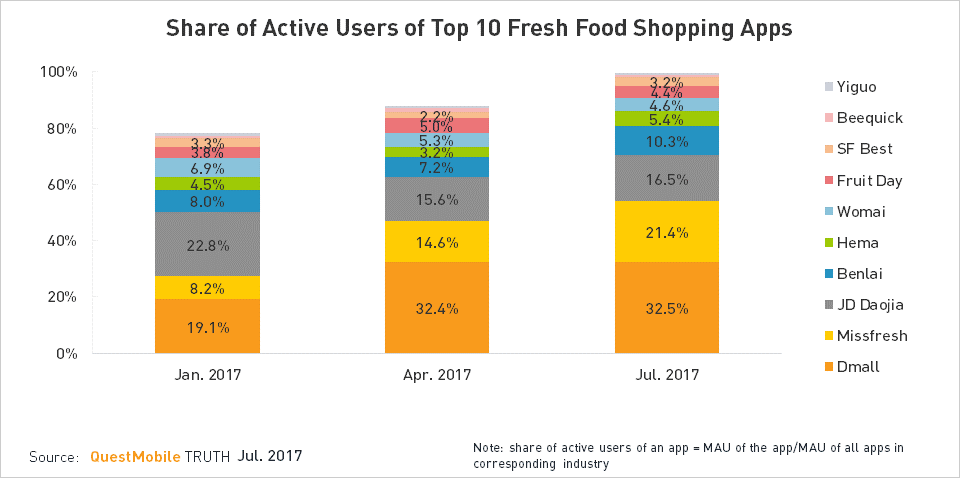

Share of Active Users

Fresh food shopping apps experienced intense competition in share of active users since Jan. 2017. Dmall was gradually getting dominant market position with the share of active users climbing to 32.5% in Jul. As the share of active users expanded rapidly in the first half of 2017, Missfresh may become a tough competitor in the future. In spite of some decline in both the number and share of active users, JD Daojia saw certain recovery of the two indicators in Q3. Benlai ran smoothly with slight increase of share of active users. Hema captured 5.4% of active users in this industry, although it just operated for less than two years.

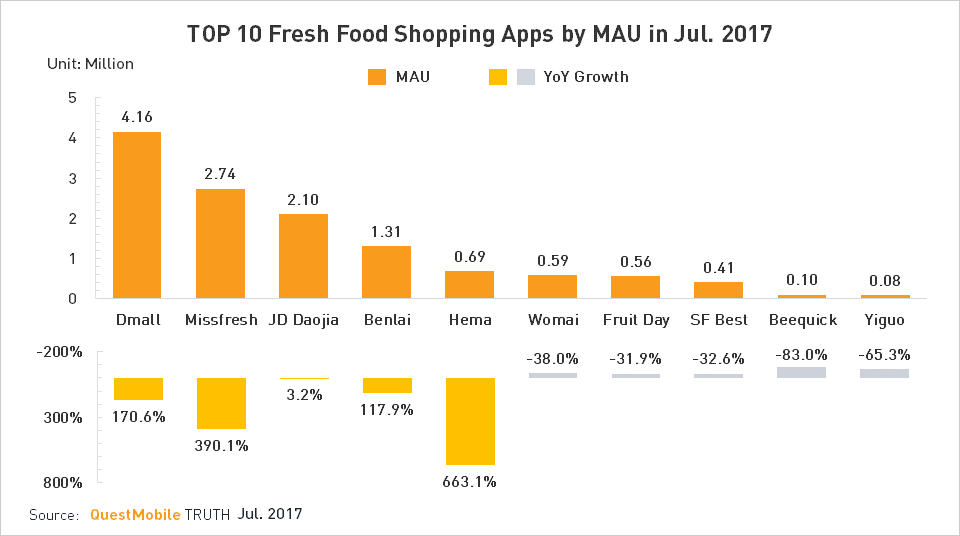

A Gradually Concentrated Market

The data in Jul. 2017 show that the top 5 apps in terms of MAU mostly doubled their MAU comparing with the same period of last year, while the last five apps in the top 10 list all experienced YoY decline of more than 10%, so this market is becoming increasingly concentrated. Specifically, with YoY MAU growth of 663%, Hema is doubtlessly a dark horse of this industry in 2017.

DAU and Activation Rate

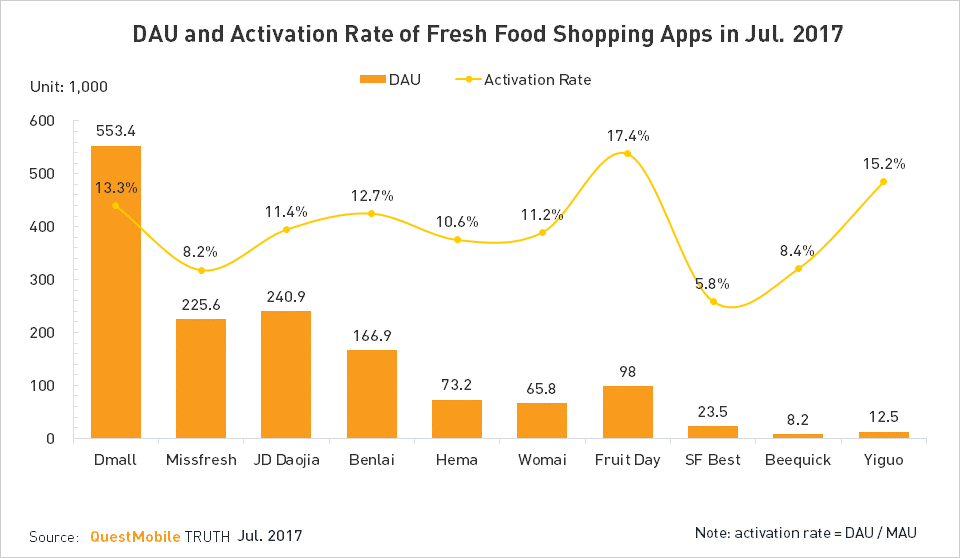

All fresh food shopping apps, no matter what categories of goods they operate or what operating models they adopt, their activation rate of users were all below 20% in Jul. 2017 which is related to users’ demand for fresh food and their purchasing frequency.

Overlapped Users of Fresh Food Shopping Apps and Comprehensive Online Shopping Apps in Jul. 2017

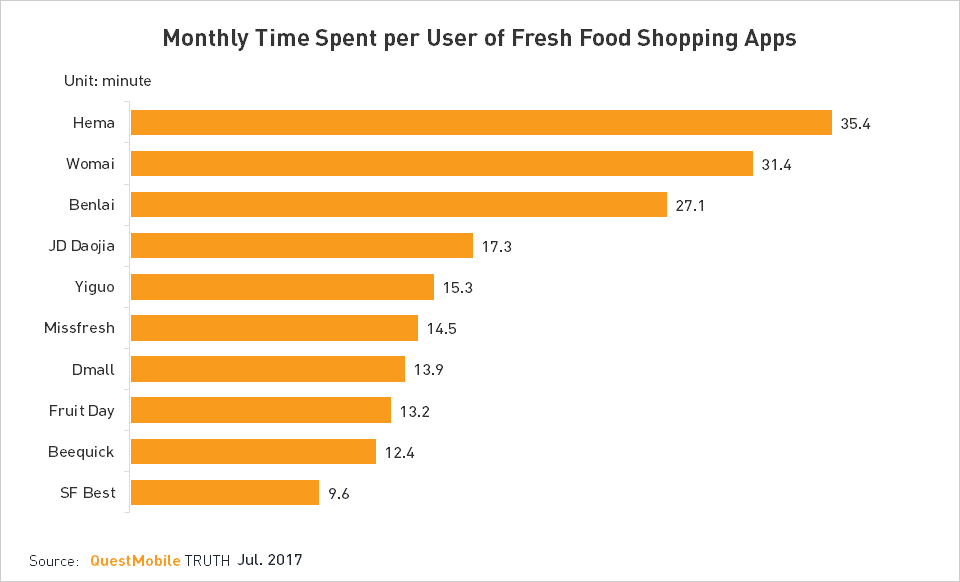

Monthly Time Spent per User

Hema, Womai and Benlai have some advantage in monthly time spent per user.

Monthly Sessions per User

Fruit Day lead in monthly time spent per user. Generally speaking, Benlai and JD Daojia possess relatively high users stickiness.

Gender Structure of Major Fresh Food Shopping Apps

Hema, Dmall and JD Daojia all have higher proportion of male users than the industrial level. Missfresh basically has balanced male and female users, while Yiguo is more favored by females, with the proportion exceeding 80%.

Age Structure of Major Fresh Food Shopping Apps

JD Daojia, Missfresh and Hema’s users are relatively young who are mostly below 30 years old, and the proportion of users below 24 years old is obviously higher than the industrial level. Yiguo is relatively attractive to young and middle-aged people, as most of them are from 25 to 35 years old.

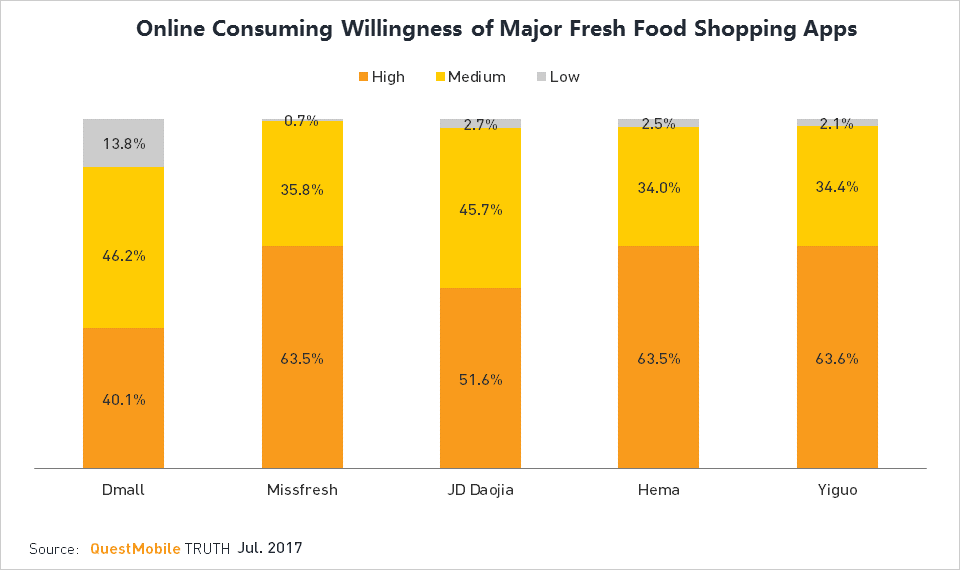

Online Consuming Willingness of Major Apps

Fresh food shopping app users possess relatively strong economic strength, as over 85% of various fresh food app users have medium to high online consuming willingness.